The Week Behind

CPI and PPI came in lower MoM but above the estimates. Wednesday’s eco-data, especially retail sales, suggest the economy is stronger than thought at the start of the year. Together, this induced hawkish Fed speakers and bearish analysts to call for 6-8% on Fed Funds. In response, investors rotated to beaten-up, defensive sectors in the market by taking profit in growth. Despite the late-week rotation, the NASDAQ outperformed, squeaking out a 0.59% gain. The DOW ended the week only 0.13% lower. The S&P lagged, dropping 0.28%.

Highlights

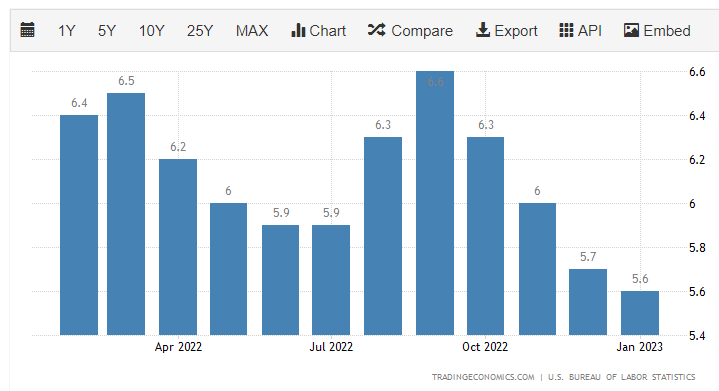

- Core CPI printed 5.6%, down from 5.7%, but 0.1% above the 5.5% estimate.

- Retail sales came in at 3%, the biggest increase since March 2021, meaningfully above the 1.9% forecast. A surprise of this magnitude implies the U.S. economy is not only strong but may be reaccelerating.

- Building permits – 1.34M act. v. 1.35M est. – and housing starts – 1.31M act. v. 1.35M est. – both came in below consensus. The former is a wash, but the latter is not constructive for housing disinflation.

- PPI printed 6%, down from 6.5%, but above the 5.4% estimate.

Revival of Fed-Risk

At first, January Payrolls was interpreted as an outlier. Powell more or less endorsed that view at the Economic Club of Washington a few days later. In theory, a strong labor market is tolerable so long as inflation continues toward the 2% target. However, while CPI and PPI continued to cool, the rate of change is plateauing. Furthermore, Wednesday’s eco-data suggest the economy may be heating up, which is a tailwind for inflation.

If the Fed feels the economy is too hot to foster disinflation, then the Fed will likely go higher than currently priced-in. Hawkish Fed members and bearish strategists took this opportunity to call for 6-8% on Fed Funds. Given we’ve priced in 5%, this implies 100-300 bps of tightening may need to get priced-in. The more bps of tightening to price-in, the more potential downside for stocks. Consequently, while I think it premature, this reintroduces Fed-risk – the Fed causing a recession by raising rates too high – into the market, which gives the bears the type of potent ammunition they have not possessed since October’s low. Therefore, we cannot ignore the growing risk associated with February Payrolls, releasing March 10th. If the report indicates the economy is reaccelerating, then I think 50 bps is back on the table.

Personally, I am not buying it. The notion the Fed would go between 6-8% because of one month’s data is as, if not more, unreasonable as the idea they would cut at the end of 2023 because inflation data was benign for a couple months (November 2022 – January 2023). Either outcome would require much more supportive data. Furthermore, the Fed knows their policy operates with a lag. The Fed began tightening in March 2022. Initial signs are just now beginning to show up in the real economy. The Fed knows the full effects have yet to be realized. I think the Fed wants to move slower; play for time; better understand their policy’s impact. That being said, just because I don’t buy it does not mean the market will not trade down if those hikes get priced-in. If February Payrolls generates that type of sell-off, I would be a buyer. For a more detailed take, click here.

The Week Ahead

This week, PCE, the Fed’s preferred inflation measure, releases Friday. If too hot, we can expect markets to grapple with the concept of 50 bps at the next FOMC meeting. A Friday sell-off is on the table. Before we get there, we have to make it through a loaded week.

Walmart (WMT) and Home Depot (HD) report Tuesday. Information on what products consumers are gravitating towards as well as tracking trade-down provide insights on consumer sentiment and strength.

PMIs for February and existing home sales for January also release Tuesday. PMI has the potential to better inform the 25 versus 50 bps debate. Existing home sales will provide tea leaves on housing inflation ahead of Friday’s PCE.

FOMC Minutes release Wednesday. In my view, the minutes are unlikely to produce any new, material information. The minutes often reinforce the reaction seen at the FOMC meeting because the minutes reflect the event that caused that reaction.

Thursday, the first revision on Q4 GDP is released. Given the budding interest in economic strength, while these GDP prints do not often carry much weight, this could add to the aforementioned debate surrounding 50 bps at March’s FOMC and increasing the terminal rate.

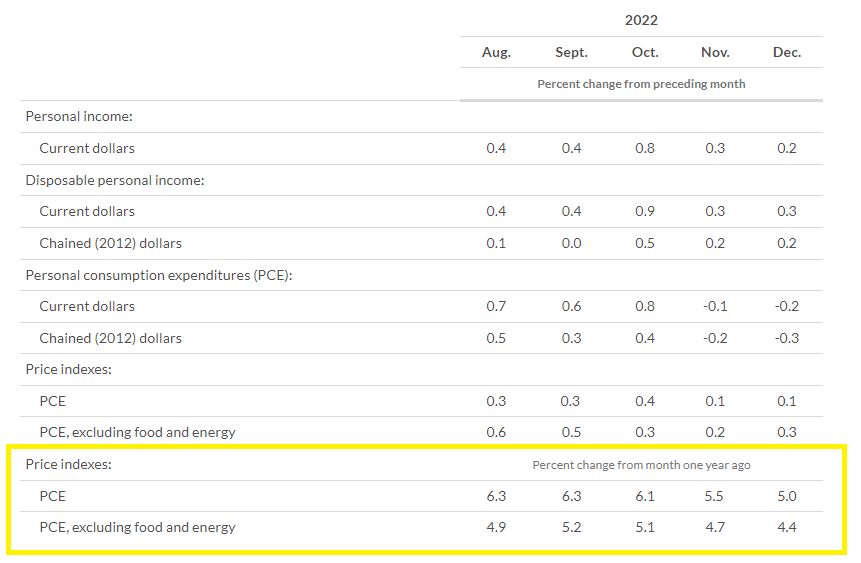

Friday is the main event: PCE. As the Fed’s favorite inflation indicator, it has the power to overrule whatever the narrative is coming into the print. Last month’s core was 4.4%; consensus for this month is 4.3%. Clearly, the estimate is achievable. 4.3% or below would do a lot to squash growing Fed-risk. I think the market would be fine with 4.4 – 4.6% because it should not be enough to change any minds. Anything at or above 4.7%, November’s number, would be problematic as it makes 50 bps in March a lock, which increases Fed-risk.

A Sneaky Move In Yields

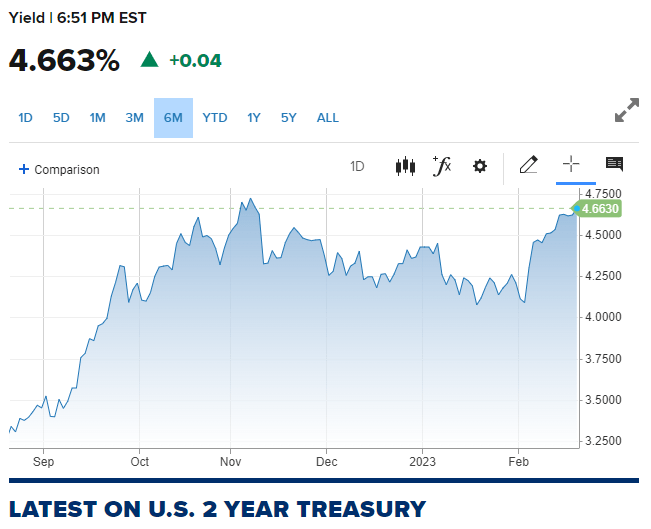

Since January Payrolls on February 3rd, the US2Y and US10Y yields have added 50 bps. If this type of interest-rate move would have occurred in 2022, markets would be down 5-10%. Instead, markets are moving sideways. When considering the ~2% increase in the U.S. Dollar over the same period and last week’s avalanche of hawkish Fed speak, the market resilience is clearly impressive.

I attribute this resilience to two factors.

First, dip buyers have returned. In the last two weeks, there have been a handful of would-be-messy sessions saved by investors buying the intraday dip. This implies there are still investors underweight stocks and/or traders interested in chasing this rally a little further.

Second, markets may be looking past Fed-risk. Coming into the year, the concern was a first quarter earnings collapse, which did not happen. If Fed-risk is only 25 – 50 bps, as opposed to 100 – 300, then investors can look past it on the premise that 25 – 50 more is not significant to earnings guidance relative to the 425 – 450 introduced in 2022.

It is hard to determine how enduring these factors are. The next yield-related stress test likely comes from the US2Y. At 4.66%, it is the closest to challenging its cycle high of 4.73%. This is a pressure point worth monitoring as it could scare dip buyers or force the market to better appreciate Fed-risk.

Leave a Reply