Last week, I published a natural gas slide deck. Since then, the commodity has fallen further. Money put to work at the time of publication is likely in the red. I acknowledge that I have been wrong in the very short term. However, I am reiterating my bullish stance because nothing material has changed. Given the nature of the recent move, it seems an appropriate time to provide additional guidance.

Executive Summary

- While I acknowledge I have been wrong since releasing the deck, I reiterate my bullish stance.

- Nothing has changed to fundamentally challenge the investment thesis.

- The incremental decline improves risk-reward.

- Natural gas stocks are facing one or two headwinds.

- The dominant headwind is the commodity’s continued fall, pressuring all natural gas stocks.

- The second is investor concern surrounding variable dividends based on commodity prices. This risk is not present in fixed dividend stocks.

- Do not fight the tape: Until natural gas prices meaningfully stabilize or recover, it is too early to put more/new money to work.

- However, $1.6 is my “too good to ignore” price.

- Wait for earnings to provide clarity on the dividend, especially for variable dividend stocks.

- Variable dividend stocks have an investor-class that cares more about the dividend than anything.

- If the dividend cut is too deep, the stock will fall as this investor-class sells out.

- It is possible pessimism toward energy stocks is keeping a lid on the associated commodities due to institutional hedging.

The Two Pressures Plaguing Natural Gas Stocks

All natural gas equities (stocks) are facing macro pressure. A subset of these stocks also face a micro pressure. As long as these headwinds are present, natural gas stocks will have a hard time performing.

The Macro Headwind

The commodity’s further decline continues to drag the associated stocks down with it. The relationship is justified. These companies sell natural gas. As the price of natural gas declines, company revenues are declining simultaneously. While the recent decline does not alter my stance, it does indicate the need to wait for a narrative shift. Until it does, this downward pressure will persist, keeping a lid on natural gas stocks.

The Narrative

Natural gas lost another 11% this week, closing at ~$2.26 from ~$2.55. I attribute the move to increased recession risk associated with a Fed Funds Rate above 5.25%. A higher Fed Funds Rate increases recession odds, which decreases the expected future demand for all goods, including natural gas.

My Contrarian Stance

I disagree. The reason the Fed would go above 5.25% is because the economy is accelerating and inflation is stubborn. Both inputs suggest the price of natural gas should move higher, not lower. An accelerating economy implies future demand is increasing, not decreasing. Stubborn inflation suggests commodity prices should be elevated, not deflated and deflating.

At $2.26, the price only reflects recession probability. It does not reflect why the probability has increased (potential for economic acceleration), its role in global energy infrastructure, and China’s reopening. A lot of the “bad” and none of the “good” is priced-in, which is why I believe natural gas is undervalued.

Admittedly, I felt the same way, and made the same argument, last week when natural gas was higher. I am reiterating my stance because the fundamental thesis is unscathed, which means the additional decline improves risk-reward. However, I am not sure what shifts the narrative. Until it shifts, as illustrated by a recovery in the commodity’s price, it is too early to add new capital to the space.

The “Too Good To Ignore” Price

$1.6 would force me off the sidelines and make me a buyer. Only two times in 25 years has natural gas traded at this level. The China growth scare in 2015 and the COVID crisis in 2020. In my opinion, whatever the economy is facing today is not as severe as 2015 or 2020. $1.6 creates a compelling risk-reward scenario that will undoubtedly attract value-seekers and commodity speculators at the same price bears can declare victory and cover their shorts.

The Micro Headwind

In 2022, energy companies championed the variable dividend. A dividend equal to a fixed pay plus a variable pay levered to energy commodities. 2022 was a tough year for equities, which made these high dividends extremely attractive. Historically high energy prices via Russia’s invasion made these yields possible. By November (2022), energy commodities had given back all those gains and then some. As a result, the variable dividend is in question, which is a major concern for investors.

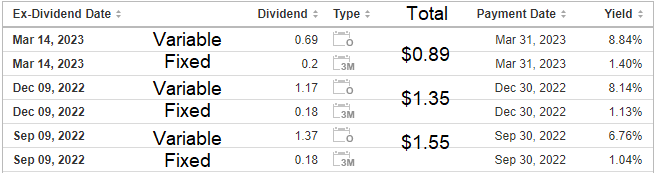

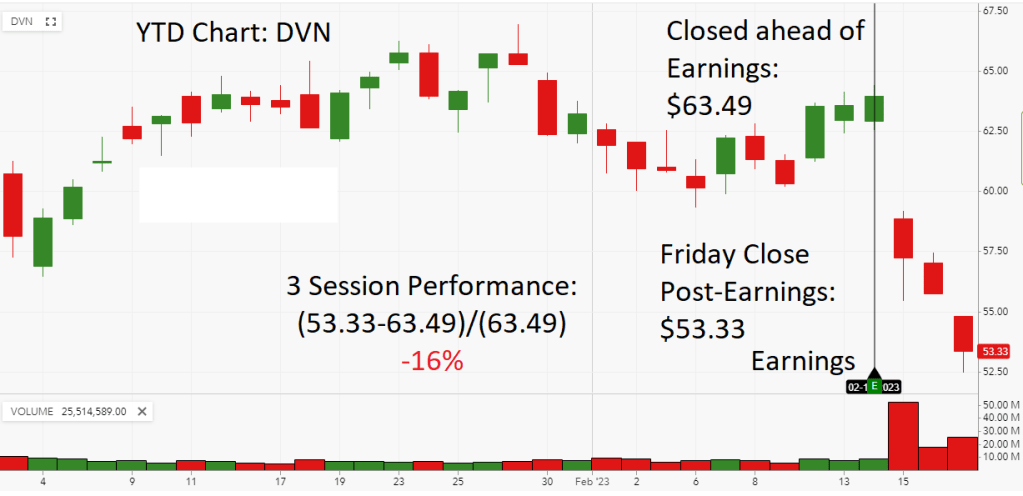

A Case Study: Devon Energy

Devon Energy (DVN) is a poster child of the variable dividend. When DVN reported February 15th, they announced a lower total dividend due to a lighter variable payout. In the three sessions that followed, DVN dropped 16%. The report was far from perfect, but a 15% loss is indicative that a meaningful portion of investors exited the stock. I believe the exodus can be accredited to the dividend-focused investor-class.

The takeaway is that variable dividends attracted a certain type of investor that will not hesitate to leave if the dividend cut is too deep. DVN’s post-earnings reaction shows us a large investor-class is more concerned with dividends than commodity prices. Consequently, before buying or adding, you need to wait for earnings to get clarity on the dividend, especially for variable dividend stocks.

Stocks with only a traditional dividend do not carry the same risk because this specific investor-class is not present.

My Sneaking Suspicion

While oftentimes it is the underlying commodities – natural gas, oil, etc… – that leads the stocks up or down, sometimes, the stocks can lead the commodities. This can occur for a number of reasons. In this case, I think hedging may be partially responsible for the commodity’s decline.

Energy is a crowded trade: most firms have a sector overweight rating, which means a lot of institutional money is in the space. Consequently, if you are an institutional investor with a large position in energy stocks, you may want to hedge your position by shorting energy commodities. As a result, portfolio losses experienced in energy stocks will be offset by gains made in the commodity shorts.

Therefore, it is possible the extreme concern surrounding variable dividends has prompted “smart” money managers to initiate substantial commodity short positions to hedge their stock positions. When there is an overwhelming short position on any asset, the price of that asset is being manipulated artificially low. By extension, the price of the associated stocks are being manipulated lower as well. If this is true, it could mean that once dividend concerns are settled and energy stocks stabilize, institutional managers will begin closing their commodity shorts, allowing the price of natural gas to revert back up to the mean, generating a macro tailwind (sector-wide boost) for natural gas equities.

My suspicion is pure conjecture in that there is not a lot of evidence available to back it. Data that does, such as the commitment of traders (CoT) report, indicate that natural gas short positions are relatively high. The CoT’s red line measures large traders’ short positions: the more negative, the more short. However, traders familiar with this data will tell you it is best used to confirm trends or countertrends, not anticipate them.

What To Do Now

If you already have money to work here, then there is not much to do. For variable dividend stocks, if in the green, then consider trimming ahead of earnings due to the extra risk relative to fixed dividend stocks. Otherwise, I would collect dividends and wait for a better opportunity. This opportunity comes when the commodity narrative changes, which indicates the foremost selling headwind may become a buying tailwind. Once the narrative shift is underway, you can shift your primary focus to individual stocks. The stock-specific opportunity comes after earnings provide dividend-clarity and any resulting single-stock volatility stabilizes.

Leave a Reply