In bear markets, stocks have a tendency to behave like commodities, trading up and down together based on the macro. Bull markets are different; they feature differentiation.

Throughout 2022, there was no differentiation. Economic sectors were judged by their weakest link. On two separate occasions in 2022, negative headlines regarding Snapchat (SNAP) brought down the entire digital advertising cohort. Despite the difference in size and advertising model, Meta (META) and Alphabet (GOOG) dropped 5-10% in sympathy. The market reacted as if SNAP, GOOG, and META were commodities: one and the same.

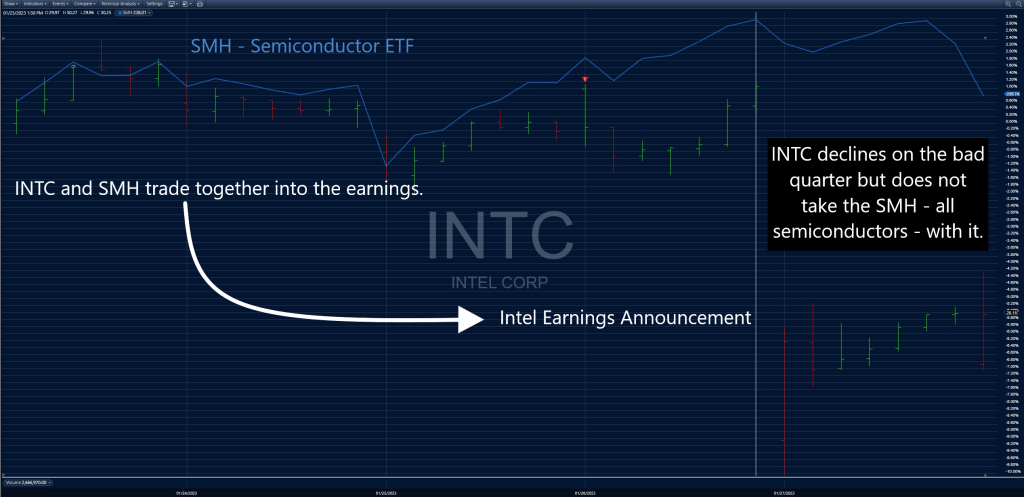

The same occurred in semiconductors. Whenever Micron (MU) or Intel (INTC) reported a stinker, it spilled over into higher quality names: Nvidia (NVDA), Advanced Micro (AMD), Broadcom (AVGO), etc… The revenue drivers and end markets for all of these companies differ. Yet, by punishing all of them, the market’s treatment implied these companies all made the same exact chip and sold to the same exact customer.

Clearly, these reactions were nonsensical, but typical of a bear market driven by fear.

Early in 2023, there are signs of differentiation. INTC’s recent quarter was arguably the worst in its history. While the whole sector opened lower on the news, all but INTC were back in the green by the close. The market realized INTC’s failure was not an indictment on all semiconductor companies and reacted accordingly.

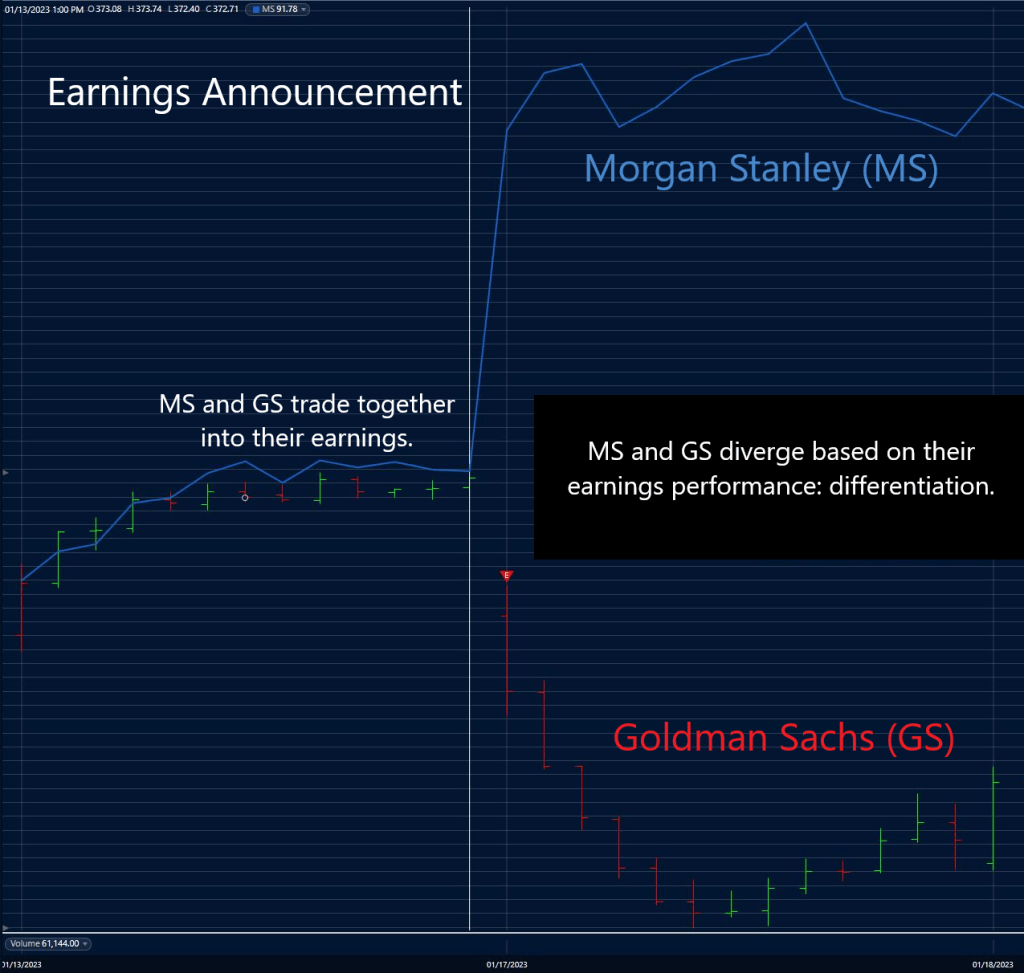

Similar behavior occurred when Goldman Sachs (GS) and Morgan Stanley (MS) reported on the same day earlier in the year. GS had a breakdown quarter. MS had a breakout quarter. GS fell 5-8%. MS rallied 5-8%. Instead of jumping to the conclusion that GS’s weakness would eventually ruin MS’s success, the market reasonably rewarded MS’s superior execution and punished GS’s lackluster performance.

The market is getting comfortable enough to distinguish winners from losers. One weak link does mean weakness throughout the proverbial chain. This behavior is healthy for markets and encouraging for stock pickers. Differentiation suggests the bear’s power over the market is at an all-time low.

As of January 31st – 4:30PM – SNAP headline earnings hit the wire. The guidance calls for the slowdown in digital advertising to worsen. In the post-market, SNAP dropped 15%. META only dropped ~2%. GOOG remained unchanged. This is a much less fearful and far more rational response than witnessed in 2022. With the FOMC Meeting scheduled for 2PM, it will be hard to use today’s (2/1/23) session for further observation. However, the post-market reaction alone provides additional evidence of differentiation in the market place.

I am not implying the days of broad market sell-offs are over. Nor am I implying a new bull market is close at hand. However, I am suggesting 2023’s market is showing much healthier tendencies than 2022’s. Consequently, when we do get broader sell-offs, like we might with today’s FOMC, and the shock subsides, it could be an opportunity to buy. There is now a greater probability the market will be willing to correct any mistakes made in fear.

Leave a Reply