February 2023

-

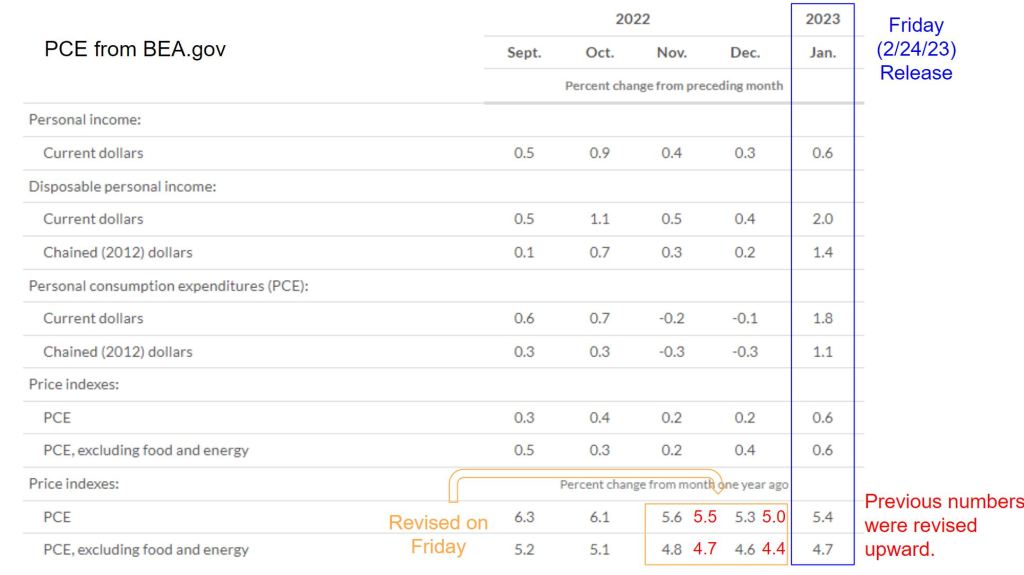

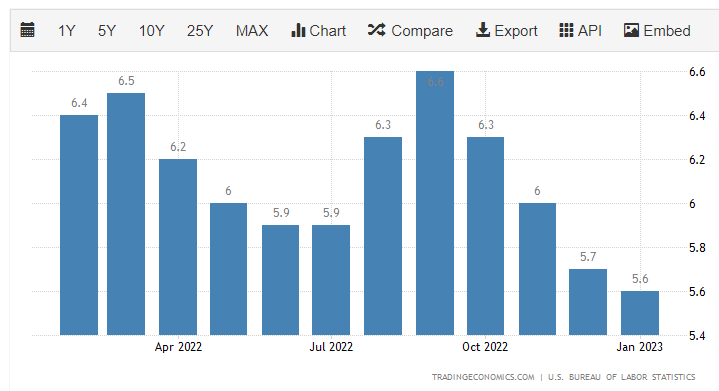

The Week Behind CPI and PPI came in lower MoM but above the estimates. Wednesday’s eco-data, especially retail sales, suggest the economy is stronger than thought at the start of the year. Together, this induced hawkish Fed speakers and bearish analysts to call for 6-8% on Fed Funds. In response, investors rotated to beaten-up, defensive…

-

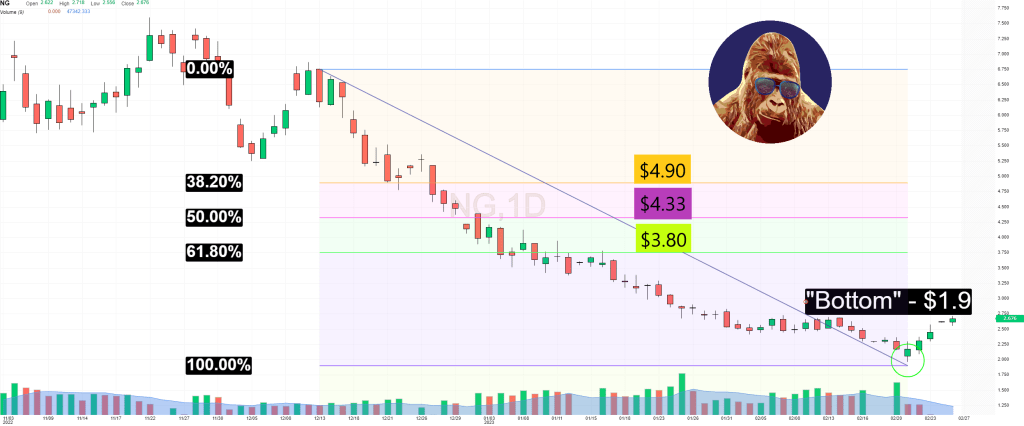

Last week, I published a natural gas slide deck. Since then, the commodity has fallen further. Money put to work at the time of publication is likely in the red. I acknowledge that I have been wrong in the very short term. However, I am reiterating my bullish stance because nothing material has changed. Given…

-

A Shift In Emphasis Despite a vast number of companies reporting before and after each session, economic data dominated this week’s tape (2/13 – 2/17/23). The market is shifting its emphasis from the micro – company-specific developments – to the macro – economy-wide developments. While this shift occurs quarterly, it is worth noting because in…

-

I am long LNG and CTRA Click here for a download version of the slide deck.

-

The Week Behind Although all the majors ended the week in the red, the upward momentum and sentiment is still intact. CPI anxiety, which releases Tuesday morning, was likely the culprit for the trepid tape. However, nothing material changed. Assuming inflation data behaves, which I believe it will, I think the bulls will remain in…

-

The Week Behind While Payrolls came in ghost-pepper hot, soft landing sentiment generated by the FOMC meeting and mega-cap earnings proved to be the greater force. Net-net, the FOMC meeting and mega-cap earnings earned the bulls enough credibility to award them the benefit of the doubt until data concretely supports the bear case of an…

-

Last week, I wrote a piece explaining how tech layoffs may imply slower growth for the mega-caps in 2023. If you haven’t, then I recommend skimming it; the implications came to fruition for MSFT, AMZN, AAPL, and GOOG. As each announced, the post-market reaction was mixed but became decisively negative once forward guidance revealed slower…