The Week Behind

Despite a sloppy session to end the week via Snapchat’s (SNAP) results, the major indices continued their climb upward to end the week, and the month, in the green. The Dow added 1.29%, the S&P500 managed 2.55%, and, shining the greenest, the NASDAQ climbed 3.33%. Jobless claims showed a slight increase. Consensus is that this number was goldilocks: an increase big enough to satisfy the FED and small enough to not spook the market.

Highlights

- While still at historic levels, the U.S. Dollar finally snapped a weekly winning streak, closing lower on the week. A historic FED tightening cycle coinciding with historically high recession risk in Europe are the primary forces behind the Euro-Dollar spread. I believe this move suggests the bull thesis surrounding “peak hawkishness” is gaining credibility as such implies the former is beginning to roll over.

- Multiple yield curves entered and remained in inversion. While the spread remains healthy between the 3-month and 5-year, the 2-year yield has found itself inverted with the 30-year, 10-year, and 5-year.

- Earnings from AT&T (T) and American Express (AMEX) shows that while the lower-income consumer may finally be cracking in the face of historic inflation via payment delinquencies at T, it has yet to appear in the behavior of middle-to-upper class consumers as per AMEX’s strong report and guide.

A Technical Perspective: The State of the Rally

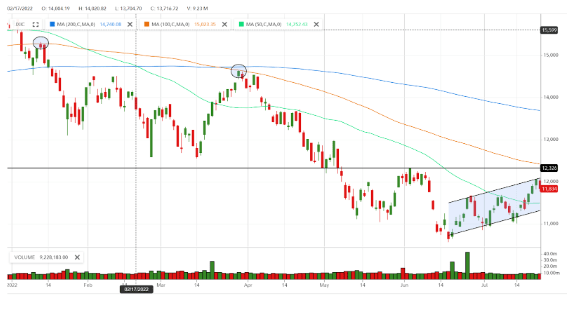

While most analysts are analyzing this rally through the SP500, I decided I would look at it via the NASDAQ for two reasons: First, this bear market originated in the NASDAQ and hit there the hardest. The bottom needs to form there before it can form elsewhere. Second, the big tech companies reporting this week represent a disproportionate amount of market capitalization in the NASDAQ. It is the index with the most at stake. Below is a YTD chart of the NASDAQ.

Resistance: 100d SMA

Draw your attention to the circles at the relative peaks in January and March. You’ll notice, each time the chart makes a move for the orange line, the 100-day simple moving average (SMA), it fails to break above it. In the 1H22 (1st of half of 2022), the 100d SMA has been a major test for the NASDAQ. If we can sustain a rally above that line for long enough, the trendline will begin sloping upward, illustrating a change in the dominant trend from negative to positive.

The Current Rally: Black Trading Channel

Next, looking at the channel, the current rally looks much more sustainable than the rallies before it: gradual upward trend containing higher-highs and higher-lows.

A Potential for a Higher-Low: The Blackline

The blackine, if breached, would represent a higher-high for the indices within the dominant trend. Up until now, each bear market rally has failed to reach a price level above the prior rally’s high. In my view, until that price-level is sustained for a couple sessions with supportive volume, there is no evidence this rally is anything more than another bear market bounce.

Bring It All Together

While the current rally features a better technical pattern compared to past rallies, until a price level above the last rally’s high is sustained, the blackline, to form a higher-high within the dominant trend, there is not enough evidence to make a legitimate case that this bounce is “the bounce”. Throughout 1H22, we have witnessed these rallies challenged by the 100d SMA only to be ultimately defeated into a new leg lower: Buyers have yet to defeat sellers at the 100d SMA. The NASDAQ is on a collision course at an extraordinarily busy time with the FED’s July Meeting and big tech earnings – AAPL, MSFT, AMZN, and GOOG – as the headliners.

The Week Ahead

Hope you all got some sleep because this could be the busiest and most consequently week of the year. We’ll limit this to a schedule because listing the unique ramifications of each would be anything but brief. However, despite the obvious importance of these prints, I think Jermone Powell’s Press Conference following the FOMC is this week’s heaviest hitter. The quality of earning did not usher in this bear market, FED tightening did. This rally is based on the premise of peak hawkishness. If Powell makes comments that suggest the contrary, this rally’s premise becomes faulty jeopardizing both this rally and the most recent lows.

Monday:

- NXP – major automotive semiconductor supplier

Tuesday:

- Before the Open: UPS, KO, MCD, GM

- After the Close: GOOG, MSFT

Wednesday:

- FOMC Meeting and Press Conference

- After the Close: F, META

Thursday:

- Before the Open: PFE, MRK,

- Initial and Continuing Jobless Claims

- After the Close: AAPL, AMZN

Friday:

- Before the Open: XOM, PG

- PCE Inflation

A Rally Supported by Relative Certainty

Another factor many attribute to this rally is rising certainty of U.S. paper recession: two consecutive quarters of GDP contraction. Now that we are “more certain” of recession, we can focus on a more narrow range of outcomes, allowing us to be more realistic with respect to its severity. Instead of incredibly volatile swings trying to price-in either the mother-of-all recessions or no recession whatsoever, a more narrow range of outcomes allows us to more accurately value a company. To me, the fact that we’ve suddenly stopped caring about the multiple yield curve inversions is a both compelling and silent sign that the majority have already accepted the leading indicator’s prediction of recession.

Markets hate uncertainty. Markets are most volatile when we are the most uncertain. While a lot more certainty will be needed before the waters calm, many view the question of recession as a fairly meaningful one. With it answered, a meaningful amount of certainty has entered the market. That certainty, with a little supporting evidence from the first two weeks of earnings, has left us more certain than not that our realistic thoughts on recession are less severe than our emotional ones. While I don’t think it is enough to end this bear market, I do think it’s a fair reason for the market to rally from extremely oversold conditions.

I hope you all have a great week. As for me, I am out of the country for a wedding. Consequently, I will not send a brief next week because I will not be able to study each event in real-time or with enough care to feel comfortable writing about them. In two weeks, assuming the market is still around, we’ll pick it up where we left off.

Leave a Reply