The Week Behind

At the beginning of the week, all eyes were on the FED. Bears and bulls were placing their bets on one of two seemingly binary outcomes. The bears called for the next big leg lower. The bulls called for the start of a sharp, May-contained rally. Neither came to fruition. This provides evidence supporting what many have already come to terms with: there is no precedent for our current situation, and no one on either Wall Street or Main Street knows what’s going to happen next.

On the heels of a unanimous 50bps hike and Powell saying a 75bps hike was not actively being considered, shorts betting on a 75bps hike were quick to cover. Unfortunately, on Thursday, the market did not follow through, giving up all of Wednesday’s rally. Friday’s trade had its swings but ultimately ended about even, near levels seen prior to Wednesday’s presser.

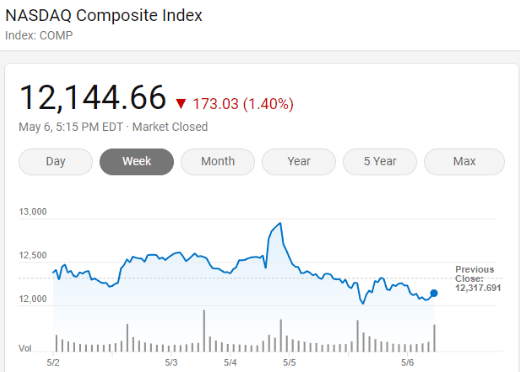

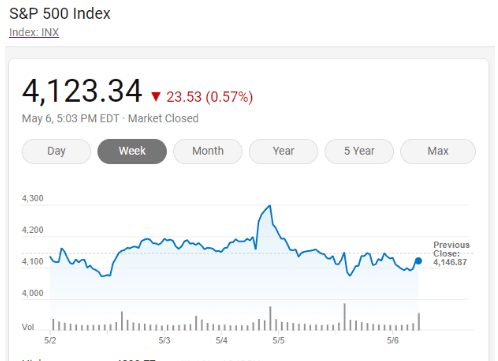

To summarize, index investors could have slept through the week and woke up to relatively unchanged investments: Dow down 30bps; S&P down 57bps; NASDAQ down 140bps. The internals are worse, but, when experiencing movements like these, it is prudent to zoom out a little to take better stock of the situation.

The Situation:

The market’s vicious turnaround suggests the current consensus is that the FED is not as committed as need be to fight inflation. Consequently, the market believes the FED will need to overtighten at a later date when growth is slower, increasing the chances of a FED-caused recession.

In my view, it is the FED’s credibility problem causing a bulk of the turbulence in the market. There is no model or precedent for this situation. Uncertainty is exceedingly high, and the markets have a low tolerance for uncertainty.

Personally, I think the interpretation of Powell’s comments are incorrect. The exact quote, “A 75 basis point increase is not something the committee is actively considering…”. The majority view is that the FED has taken 75bps off the table permanently. My interpretation is that the data up to this point did not warrant considering a 75bps hike. If the data changes, then the committee may begin actively considering a 75bps hike.

However, as per the price action, my view is currently the minority. I don’t think my view will become the majority view. Therefore, it is time to look for signs of capitulation or for a narrative shift surrounding the FED’s credibility.

The Week Ahead

Luckily, there is a chance the narrative shifts. On Wednesday, CPI for April is released. Currently, the market believes inflation is too hot for the FED to handle via 50bps hikes and incremental balance sheet reduction. If core CPI continues to cool and the argument for peak inflation strengthens, then Powell could suddenly look like a genius for not over tightening just as inflationary pressures begin to roll over. The market could begin to stabilize. However, skepticism toward the same FED that insisted this inflation would be “transitory” is understandable. They were wrong then; perhaps, they are wrong now.

If the core number fails to sooth inflationary fear, the bears’ control will grow stronger as faith in a soft/softish landing wanes. With a majority of stocks – oil, utilities, healthcare, and consumer staples excluded – at major inflection points to start the week, the next move down could be capitulatory.

As per capitulation, watch for the following:

- VIX to break 40

- 10-year to spike to 3.5%

- 90-10 advancing-declining on NYSE

- AAPL below $150; MSFT below $270; TSLA below $800.

I would provide index levels, but I hypothesize true capitulation will not be achieved without these stalwarts falling.

Lastly, the 10-year yield appears to be the bond market’s vote of confidence. Historically, the 10-year is a favorite for preserving purchasing power against inflation. If bond investors are selling it, they do not think the FED can tame inflation, which sends the yield higher. This process will continue until the yield is attractive enough to buy. As this process occurs, the stock market is gauging how bad inflation will be by the bond market’s treatment of the 10-year and repricing stocks on the fly.

Remember, now is not the time to panic. Now is the time to preserve capital where you can, have conviction in what you own, and get a shopping list ready. The risks to the market are not systematic. Recessions happen. They set the floor for the next bull run and provide a great entry for wealth creation. This has been the worst annual start for bonds and stocks in the last 40 years. That means a lot of damage has already been done, and there is a lot of money waiting to be, and that needs to be, redeployed.

Leave a Reply